Debt Service Coverage Ratio (DSCR) is an important financial metric used by lenders to evaluate a borrower’s ability to cover its loan obligations. It measures the relationship between a company’s operating income and its debt obligations, specifically its ability to repay principal and interest on outstanding debt. Typically expressed as a ratio, a higher DSCR indicates a stronger ability to cover loan payments, indicating lower risk for lenders.

Table of Contents

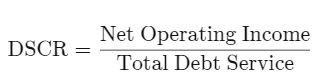

Calculating DSCR involves dividing a company’s net operating income by its total debt service obligations. Lenders generally require a minimum DSCR to reduce the risk of default. A ratio below 1 indicates that a company may struggle to meet its debt obligations, while a ratio above 1 indicates a healthy financial position.

In short, the debt service coverage ratio serves as an important tool for lenders to assess the creditworthiness and financial health of potential borrowers, influencing lending decisions and terms.

formula and calculation.

The formula for calculating the debt service coverage ratio (DSCR) is straightforward:

Here are the details of the components:

- Net Operating Income (NOI): This includes a company’s total revenue minus operating expenses, excluding interest and taxes. It shows the cash flows generated by the business before considering debt obligations.

- Total Loan Service: This includes all loan-related payments, including principal and interest, which are to be paid within a specific period, usually one year. This includes payment of all outstanding debts such as loans, bonds and leases.

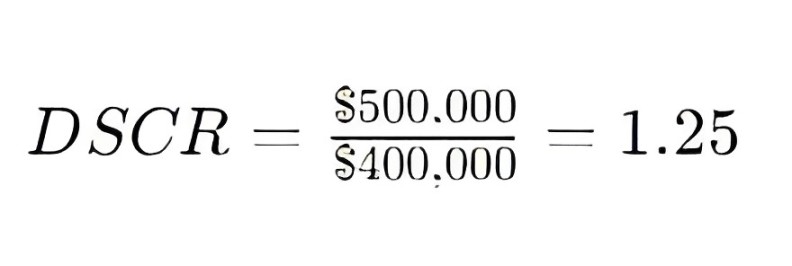

To calculate DSCR, simply divide net operating income by total debt service. For example, if a company reports net operating income of $500,000 with total debt service of $400,000, the resulting DSCR would be:

This indicates that the company’s cash flow is 1.25 times its debt obligations, suggesting a healthy ability to cover its debt payments.

Interest Coverage Ratio vs Debt Service Coverage Ratio

Interest coverage ratio (ICR) and debt service coverage ratio (DSCR) are both financial metrics used to assess a company’s ability to meet debt obligations, but they focus on different aspects of debt repayment.

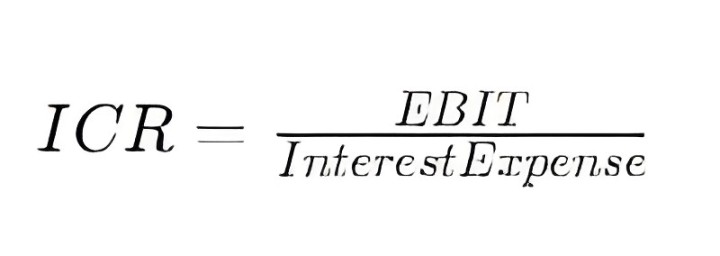

Interest Coverage Ratio (ICR):

The interest coverage ratio evaluates a company’s ability to meet interest payments on outstanding debt. It measures earnings before interest, taxes, depreciation and amortization (EBITDA) relative to a company’s interest expenses. The formula for ICR is:

A higher ICR indicates a stronger ability to cover interest payments, suggesting lower risk for lenders. A ratio below 1 indicates that a company’s earnings are insufficient to cover interest expenses, which may raise concerns about its ability to repay debt.

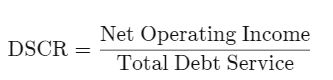

Debt Service Coverage Ratio (DSCR):

On the other hand, the debt service coverage ratio assesses a company’s ability to cover both principal and interest payments on its outstanding debt. It considers the company’s net operating income (NOI) relative to total debt service, including principal and interest payments. The formula for DSCR is:

Similar to ICR, a high DSCR signifies a healthy ability to meet debt obligations. A DSCR below 1 indicates that the company may struggle to meet its debt payments.

Key differences:

- Scope: ICR focuses solely on interest payments, while DSCR considers both interest and principal payments.

- Components: ICR uses EBIT, while DSCR uses NOI.

- Risk Assessment: DSCR provides a more comprehensive assessment of a company’s ability to meet all loan obligations, including principal repayment, making it a preferred metric for lenders assessing overall loan repayment capacity .

In short, while both ratios evaluate a company’s debt repayment ability, the interest coverage ratio specifically assesses interest payments, while the debt service coverage ratio provides a broader view by considering both principal and interest payments, Which provides a more comprehensive assessment of the financial health of the company. and ability to repay the loan

Advantages and disadvantages of DSCR

professional:

- Comprehensive Assessment: DSCR considers both interest and principal payments, giving a holistic view of the company’s ability to meet all debt obligations. This comprehensive assessment provides lenders with a clear picture of the financial health of the company.

- Risk Mitigation: A higher DSCR indicates a stronger ability to cover loan payments, thereby reducing the risk of default for lenders. This helps lenders take informed decisions about loan terms such as interest rates and loan amount.

- Standardized metric: DSCR is a widely recognized and accepted metric in financial analysis, making it easy for lenders, investors and analysts to compare the financial health of different companies in the same industry or in different industries .

- Long Term Viability: By evaluating a company’s ability to generate cash flows to repay its debts over the long term, DSCR helps assess a company’s overall financial viability and resilience to economic downturns.

Shortcoming:

- Dependence on Earnings Stability: DSCR largely depends on the company’s net operating income (NOI), which can fluctuate due to changes in market conditions, business cycles or unexpected events. This dependence may make the DSCR less reliable during periods of volatility.

- Potential Manipulation: Companies may manipulate their financial statements to artificially inflate NOI or reduce debt obligations, which can lead to errors in DSCR calculations. This may mislead lenders and investors into believing that the company’s debt servicing capability is stronger than it actually is.

- Limited Information about Cash Flow Timing: DSCR does not provide information about the timing of cash flows or the liquidity position of the company. A company may have a high DSCR but still face liquidity challenges if its cash flows are unevenly distributed or if it lacks sufficient cash reserves to cover short-term debt obligations.

- Industry Variability: DSCR benchmarks may vary across industries due to differences in operating models, capital structures and business cycles. Therefore, comparing DSCR across industries without considering industry-specific factors may not always provide meaningful insights.

In conclusion, while the debt service coverage ratio provides valuable insight into a company’s ability to meet its debt obligations, it is important to recognize its limitations to gain a comprehensive understanding of a company’s financial health and risk profile and—with the DSCR— It is important to consider other financial metrics as well.

Example of DSCR

Let us consider an example of how the debt service coverage ratio (DSCR) is calculated and what it means:

Company XYZ operates in the manufacturing sector and is seeking a loan to expand its production capacity. Here are the relevant financial figures for Company XYZ:

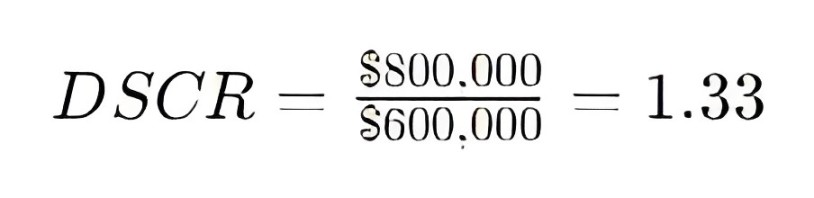

- Net Operating Income (NOI): $800,000

- Total Debt Service (TDS): $600,000

Using these data, we can calculate the DSCR using the formula:

In this example, Company XYZ has a debt service coverage ratio of 1.33. This means that for every dollar of debt service obligation, the company generates $1.33 in net operating income.

Explanation:

A DSCR of 1.33 indicates that Company XYZ’s cash flow from operations is enough to cover its debt service obligations 1.33 times. Generally, a DSCR above 1 suggests that the company generates enough income to comfortably meet its debt obligations. Lenders generally prefer higher DSCRs because they indicate a lower risk of default.

This example shows how DSCR provides information about a company’s ability to repay debt and helps lenders assess the creditworthiness of a company before extending loans or credit facilities.

Bottom-line

Debt Service Coverage Ratio (DSCR) is an important financial metric used by lenders to evaluate a company’s ability to meet its debt obligations. It provides a comprehensive valuation by considering both interest and principal payments relative to the company’s operating income.

A high DSCR signifies a healthy financial position, indicating that the company generates enough cash flow to comfortably cover its debt payments. This reduces the risk of default and provides assurance to lenders, potentially making lending terms more favorable to the company.

However, it is important to recognize the limitations of the DSCR, such as its dependence on income stability and the possibility of manipulation. Additionally, DSCR alone cannot provide a complete picture of a company’s financial health, so it must be used in conjunction with other financial metrics and qualitative analysis.

In conclusion, while the DSCR serves as a valuable tool to assess debt service capacity, it is important to interpret it in the context of the company’s overall financial condition and industry dynamics to make well-informed decisions.